Plaza-i Fixed Asset

Outline

Plaza-i Fixed Asset Management provides high usability as part of the ERP package system and also when used independently, and becomes compliant with tax reform in timely fashion.

Supporting the impairment process, lease accounting, asset retirement obligations, and IFRS, Plaza-i Fixed Asset is highly valued by many clients including financial institutions.

Plaza-i Fixed Asset handles comfortably more than 10,000 asset items. Without implementation of other modules such as General Accounting, it is possible to implement and use this module only.

Product details

Features

This module has responded to tax reform promptly and also has been used by companies listed in the First Section of the Tokyo Stock, large accounting firms, and financial institutions for more than 20 years. Plaza-i Fixed Asset is the best match with the following cases.

- Wish to use a fixed asset system which uses high-security database like Oracle, and yet which is relatively low in cost.

- Use different depreciation methods, useful life, and salvage values for bookkeeping and tax purposes.

- Wish to adopt the idea of monthly closing also for depreciation expenses and adjust the variance.

- Wish to perform transfer process for Construction In Progress (CIP).

- Wish to perform allocation of depreciation expenses per department.

- Possess a large amount of fixed assets such as factories and retail stores.

- Handles bulk asset retirement.

- Handles unique depreciation methods such as special depreciation, 160% depreciation, depreciation for strongly built construction, etc.

- Wish to carry out depreciation after impairment using the ten ninth method.

- Wish to manage all the fixed assets of the group company.

- Wish to process leasing as a lessor.

- Require bilingual process.

- Wish to integrate with the business management modules since rented inventory becomes fixed assets.

- Use Plaza-i Accounting.

Main Menu

Plaza-i Fixed Asset Management provides high usability as part of the ERP package system and also when used independently, and becomes compliant with tax reform in timely fashion.

- CIP Registration, Transfer From CIP To Asset, and Transfer To Other Account

- Asset Sales, Asset Retirement and Asset Batch Sales/Retirement, All Transfer and Partial Transfer

- Small Expensed Fixed Asset Registration

- Three-Year Depreciation Asset

- Simulation Calculation

- Impairment accounting menu

- Lease accounting menu

- Asset retirement obligations accounting menu

- IFRS accounting menu

- Fixed Asset Ledger and CIP Ledger

- Summary and Detail of Depreciation Expense, and Supplementary Statement

- Monthly Comparative Report, Allocated Depreciation by Organization

- Detail of Excess Depreciation

- Depreciable Asset Tax Return, Detail by Category

- Form 16(1)(2)(4)(6), and Form 16(9)

Detail functions

Two Sets of Useful Life and Depreciation Method for Bookkeeping and Tax Purposes

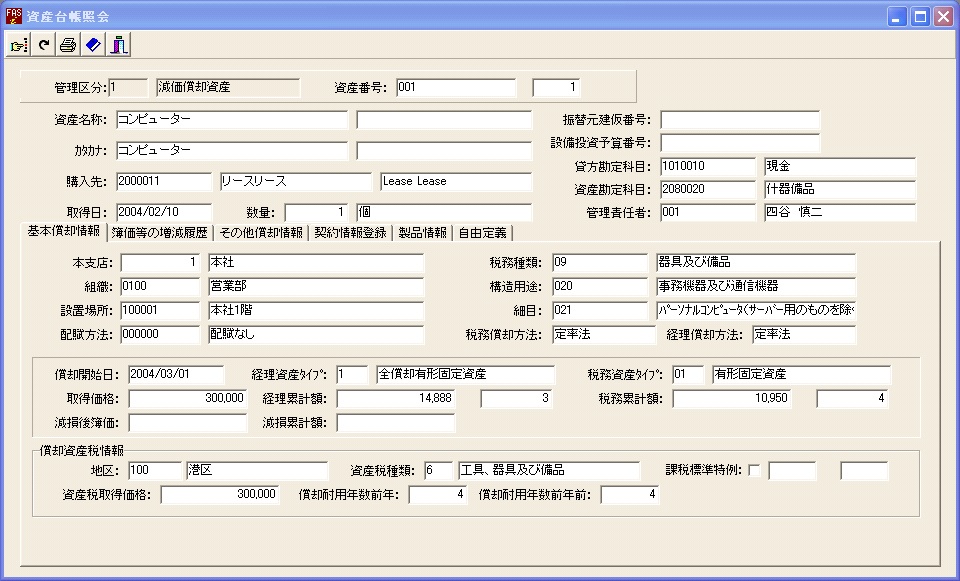

Asset Ledger Registration Screen

You can register and manage two sets of useful life, depreciation method, and salvage value for each fixed asset item for bookkeeping and tax purposes.

Excess depreciation amount will be reflected on Form 16 automatically.

This module is the best match with listed companies who record depreciation expenses in a shorter period for bookkeeping purpose, or foreign affiliated companies whose parent company adopts depreciation method with no salvage value.

Various Depreciation Method For Tax Purpose

This module supports three-year depreciation for small expensed fixed asset items.

This module supports special depreciation, advanced depreciation, and additional depreciation.

Several different methods are available for special depreciation and advanced depreciation such as direct reduction method and income disposition reserve method.

For additional depreciation, it handles multiple asset groups, which have different additional depreciation rates.

You can change all additional depreciation rates at once for the following fiscal year in Additional Depreciation Rate Code Master.

Special exception for strongly built asset items, obsolescence depreciation, calculation for the fiscal year less than 12 months, and limitation of depreciation process for suspended asset items are also available.

Change of Depreciation Method and Useful Life

Depreciation method can be changed from the straight-line method to the declining balance method, or vice versa.

Shortening of useful life and change of useful life due to the change of structure/usage is available on a monthly basis. (For shortening of useful life, please change it at the beginning of the fiscal year.)

Monthly depreciation expense limit will be recorded based on the changed useful life from the fiscal year in which useful life is changed.

Depreciation Simulation: By registering transactions of asset items to be acquired in the following fiscal year or in the later years, estimated depreciation expense can be calculated accurately for the following five years including existing asset items.

Construction In Progress

Asset items can be registered as construction in progress, for instance, in case of acquisition of a building, and then be transferred to fixed asset account.

A Large Amount of Assets

If you are calculating depreciation expense of a large amount of parts, which are small expenses, but are for long-term use, you may need to sell or retire a large amount of such assets every month.

Since Plaza-i prepares the batch retirement and batch sales screens, you can perform sales and retirement process for all the assets to be sold or retired at once by looking at the list of asset items.

In addition, due to merger/elimination of offices or organizational changes, when you need to transfer a large number of assets, the batch transfer process is possible.